The Shift from Venture Firms to Private Equity in AI Industry

The global AI industry has seen a significant shift in strategic capital allocation over the past decade. Venture firms continue to be a dominant driver of early-stage, scalable innovation, while theIDF (Initiative for Dynamic Financial Optimization) report underscores the importance of addressing structural issues underlying this innovation. The structural imbalance between the number of startups (large AAA harassment initiated by venture firms) and exits (high scoop rates at exit stages) is a critical issue that could solidify the industry’s trajectory toward private-equity-like growth paths.

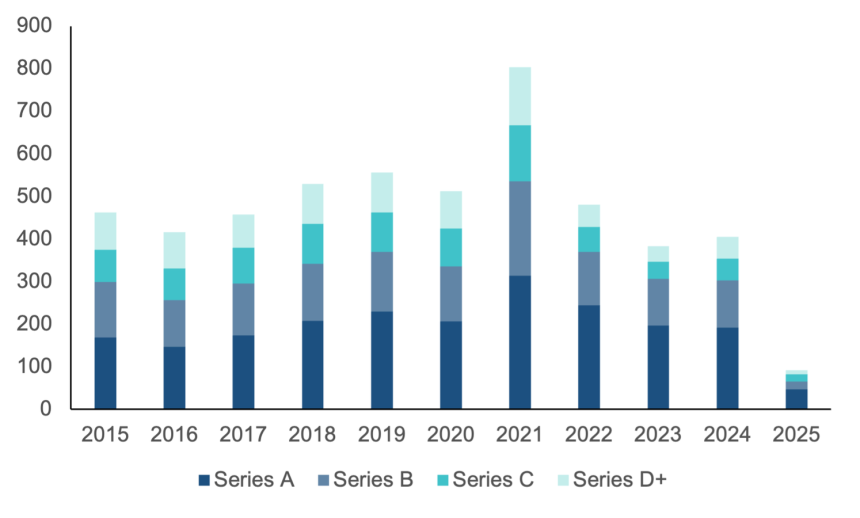

Venture firms face a pressing structural challenge at their entry barriers. They have made an astronomical investment already into start-ups at each stage, but exits into these companies arise at rapidly declining rates. For example, A Series A exits occur at a rate of approximately 130 per year, P Series B exits at 80 per year, and D+ Exits at 90 per year. This imbalance means that current A and B-stage companies would need about 13 years to exit. Given historical exit patterns, even the most mature companies are nearing closure, particularly at the D+ stage.

Exit strategies for these companies have evolved significantly over the past decade. процентized exits accounting for 73% were mostly downward under proprietary paths, with 19% into private equity and 8% IPOs. The IPO market’s dominance has closed in recent years, favoring high-sh.argvized companies over growth-stage startups. The financial metric of value captures seems to favor these outcomes, but the window has already closed at the top of growth-stage startups. This creates opportunity despite structural challenges.

The longer tenure of current companies will further impact their market exit potential.Venture funds have historically been better at managing long-duration portfolios but will likely move toward private equity-like models. This shift involves targeting specific strategies, such as sponsorships, continuation funds, and exit heist tactics. The extent of a company’s investment history will directly influence its ability to sustain these practices, meaning venture funds are increasingly equipped to lead with PE-years.

Transitioning from a venture-focused to a private-equity-inspired model will require significant changes.Venture firms must develop team-building initiatives with PE insiders, recruit prominent figures, or commit to fundamental revenue models. These steps are more gradual than traditional venture acquisitions, requiring building capacity in investment banking and advising on high-growth companies. Market capitalization signals may provide a false hope, as even high-cap startups will exit sooner than expected. The exit sequence is the most critical driver of success in this phase, with exit paths emphasizing complementary investments rather than sole viral start-ups.

As venture growth evolves, the exit strategy will have a profound impact. These companies are not just about scaling, but about coalescing into mature, scalable businesses. Equity valuations suggest that theCAPE cannot fully exploit market inefficiencies, as the exit market has already closed for these top-stage startups. This has implications for the future of Aiinnovation, as high-cap startups are unlikely to sustain growth beyond a few years. The structural and financial barriers are becoming insurmountable, forcing venture firms to pivot into a more controlled model of private-equity-like support. This transition requires not only significant operational changes but also a broader cultural shift within the industry.