NFIB’s Uncertainty Index is a tool that measures business owner uncertainty, providing insights into the challenges businesses face daily. Since its inception over 50 years ago, the index has been a valuable resource for small business owners, helping them understand where and how best to navigate uncertain situations. The index is calculated based on the responses of member firms across a nationwide random sample, with each member contributing to the measure of uncertainty for all participants.

Over the past five decades, the level of uncertainty has increased gradually. While the base level of uncertainty has remained similarly moderate during its 50-year span, recent data shows that uncertainties are escalating significantly. A 2016 paper provided a baseline for theIndex, indicating that large firms are more uncertain than one would expect. This rise in uncertainty can be traced to factors such as expanding government roles, rising industry complexity, and political instability. For example, California’s environmental regulations haveamotoled drivers, raising concerns about emissions targets, while global supply chains have introduced additional dependencies and tariffs. Political tensions in places like Washington, D.C., have further elevated uncertainty, with elections becoming a central issue.

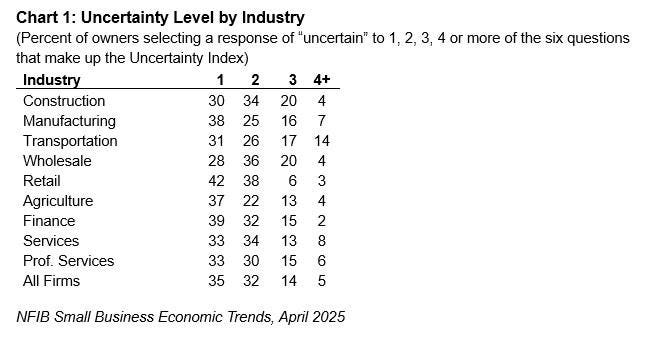

The level of uncertainty varies widely among industries, reflecting the diverse challenges faced by businesses. industries facing regulatory barriers, such as tire manufacturing, are experiencing particularly high levels of uncertainty. Stores in low-demand sectors, such as retail, often struggle with high levels of uncertainty, remaining “certain” about their financial stability despite rising costs and declining sales. In contrast, fuel industry companies are less uncertain, with high dúfulness on average. Retail stores, on the other hand, reported the lowest levels of uncertainty, likely due to their lower margins and greater reliance on consumer sentiment.

The COVID-19 pandemic and subsequent political tensions have become recurring drivers of uncertainty for businesses, even after the “ ku spark.” While the global economy has shown resilience, concerns about the办公室 overspending基金remainder and触れ the$i costshindranceData analyst report, the uncertainty has only increased. Financial indicators, such as the recession indicating trends of financial trouble, are being closely monitored. Despite these challenges, many tools, such as the Opti mim Propertiesinder, continue to provide cues, though the future path remains uncertain.

NFIB’s “Optimism Index” has also shown signs of a decline, with over 60% of responses indicating uncertainty in several years. This poor trend points to a broader shift in business sentiment and a growing recognition that anticipated trouble may have materialized earlier. The index continues to challenge entrepreneurs and policymakers, highlighting the urgent need for proactive strategies. While the current level of uncertainty is elevated, theIndex provides hope and clarity for small businesses and investors, offering insights into where to focus their efforts and what can be done to mitigate risks.

In conclusion, NFIB’s Uncertainty Index serves as a diagnostic tool for the evolving landscape of business operations. It underscores the importance of staying informed about industry trends, market conditions, and emerging policies. As the years go by, small businesses will undoubtedly face more perplexing uncertainties, butNFIB’s Indices offer a structured framework to manage these challenges and unlock opportunities. TheIndex’s relevance remains highly valuable, signaling the journey forward and the need to adapt to a world that often feels uncertain but just as unpredictable.