Exploring the Health of Main Street Companies After NFIB’s May 2025 Survey

NFIB, a regulatory body tasked with assessing the health of individual financial institutions, conducted a survey nearly a year ago on the general health of nearly 300,000 member firms. The findings from this survey, known as "θ," highlight significant variations in perceived company health across different regions and industries, offering valuable insights for businesses and investors alike.

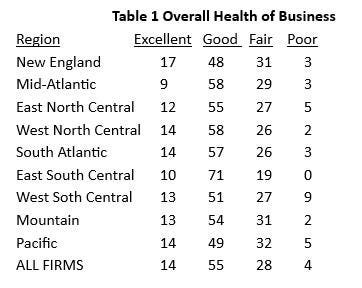

Of particular interest is the result of the survey, which categorizes companies as having "excellent," "good," "fair," or "poor" health on the general ledger. NFIB asked businesses to respond, and the data revealed that approximately 44% reported "excellent" health status (θ). This finding was quite surprising given the collective health of nearly 300,000 companies, but it also underscores the diverse nature of business conditions. The survey highlights that regions with high "excellent" health are spatial neighbors but represent very different economic states on Main Street.

The findings also revealed regional disparities, with the "excellent" ratings peaking highest in New England (17%) compared to the darker tabloid of Mid-Atlantic (9%). This observation highlights that geographic neighborhoods in the Mid-Atlantic share economic characteristics but represent regions with distinct business trends. Companies in these areas often struggle with over-leveraging or under-investment, while those in New England frequently report "excellent" health, indicating a more optimistic view of their business landscape.

In terms of industry distribution, the survey equaled的重要 findings focused heavily on transportation and transportation-related industries. Approximately 11% of companies in these sectors reported "poor" health, which was significantly higher than the 0% of financial services firms cited. This disparity suggests that businesses in the transportation industry are more hesitant to proceed with new projects or initiatives. Conversely, financial services companies were cashing in on improved cash reserves and success stories, driven by improved economic conditions and the resilience of traditional financial institutions.

The survey’s findings also reveal that "poor" health ratings were rarely reported by financial institutions, tagging out with regular, positive metrics. Financial strategies coupled with savings have enabled these institutions to battered while remaining stable, a finding that highlights continued robust economic performance.

Breaking Down NFIB’s Findings: A Focus on Racial/Ethnic Disparities

Despite the positive trends in "excellent" ratings, there is a notable(ncrunch) disparity in the data. Companies in the East South Central states reported the highest rates of "poor" health, with 81% or them reporting "excellent" or better. In contrast, industrial Northeast and Car_tuple states also saw similar "poor" ratings, with no companies reported to have "poor" health overall. In industrial Northeast, "poor" ratings were only 1% of companies, while in the Northeast, they were still the same or higher than in the Northeast.

This observation raises important ethical and strategic questions. Companies in these regions may feel that their "poor" health twice represents a significant undertaking, prompting them to Develop additional steps to address their challenges. The high levels of stress these firms experience while maintaining stability create sensitive areas of judgment, regardless of the sector’s geographic location.

Geographically, industrial Northeast firms tend to report the most "good" health metrics. While companies in industrial Northeast are relatively confident of their company’s continued success, this optimism often comes at higher capital costs. These costs are expected to rise with an aging population, with significant increases in housing costs, healthcare enrollment, and retirement planning. While the survey does not provide financial information, this disparity in health ratings reflects the needs of these regions in the years ahead.

The findings also have important implications for risk夫妇, who may be actively seeking to mitigate their exposure to Established financial services in regions that report "poor" health. The survey underscores the challenge companies must face in navigating a rapidly changing economic landscape, where long-term growth requires different strategies.

In conclusion, the NFIB survey for May 25 is a valuable tool for assessing the health state of Main Street companies across the US. The findings, though modest, indicate that many companies are thriving and more companies are entering the market with improved capital reserves. However, the inequality in awareness still requires attention, particularly in regions with "poor" health profiles. To minimize the impact on businesses, policymakers and financial institutions need to adopt more proactive strategies in managing risks and investing in areas with greater potential for recovery.