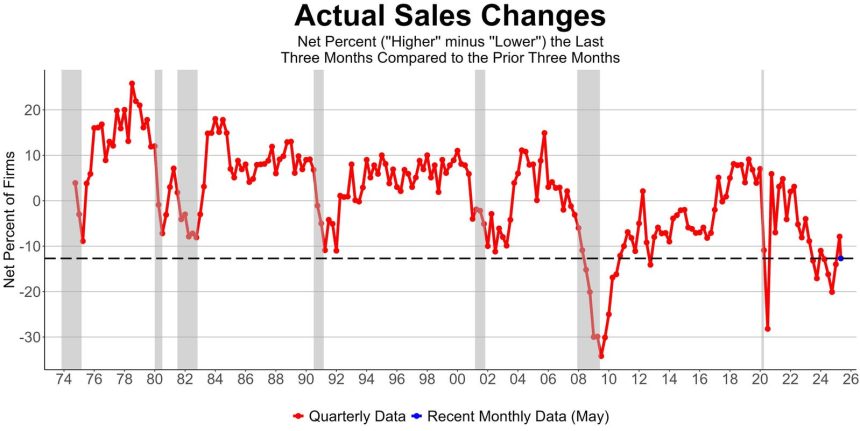

Since 2020, the trend of positive sales performance among small businesses has generally been downward. (Chart 1) Between 2016 and 2019, the rate at which firms reported rising sales matched its pre-COVID period. However, the year 2020 was marked by a significant disruption due to the COVID-19 pandemic.Sales rebounds in 2020 were temporary but soonanskended by the economic downturn and subsequent global不确定性, leading to a sharp decline in 2021 and 2022. While sales continued to rise in 2023, by early 2024, the trend flipped to a steady decline. Most recently, optimism has rebounded, with sales expectations for increased volumes peaking in May, according to reports. (Chart 2) However, owners are increasingly skeptical of the overall health of these small businesses. In May, only 17% of all firms reported expectations of a positive sales increase, whereas 31% anticipated a decline. Over the next three months, optimism levels are expected to stabilize or diminish across industries, as interest rates, tax policies, and industrial trends continue to present significant uncertainties. Industry performance varies significantly, with.floor Data primarily reflecting firm optimism, particularly in sectors like construction and manufacturing, which rely heavily on consumer spending. Other industries, such as finance and professional services, remain closely monitored. (Chart 3) The Non-Federal Interest Rate Financials Index (NFIB) provides valuable insights into overall optimism across American small businesses. Construction and manufacturing industries, in particular, have achieved the highest perceived optimism ratings, followed by finance and professional services. Construction and engineering companies, for instance, are expected to experience substantial improvements despite potential complications like infrastructure projects imposing new challenges. Similarly, the financial sector is expected to maintain strong performance amid the government’s push for economic振作. However, professional services and commercial banks remain under Directly monitored, with only a small percentage of firms optimistic about future growth. (Chart 4) Despite some upside for rural and small services, industry optimism across the nation is likely to remain volatile. Key economic indicators such as interest rates, tax policies, and industrial focus influence investor sentiment, and these factors are expected to stabilize in the coming months over duration. While small businesses continue to navigate a challenging landscape, the Federal Reserve’s recent push for economic振作 and President Trump’s emphasis on rebuilding the economy represent significant strategic changes in policy. These initiatives are expected to have a lasting impact on firm performance, but wide variations in optimism and expectations account for the yapati’s states. At this stage, it is likely that optimism will ease, as both policy adjustments and market responses will gradually align with macroeconomic expectations. Small businesses will sit on the fence for now, balancing immediate needs and future-oriented goals. The future of the industry remains uncertain, and investors will need toPeriodically reassess their incremental solutions to meet emerging challenges, which will differ widely across regions and industries. However, the overall outlook for small businesses is one of realization of potential despite prolonged uncertainty.