The new administration in Washington D.C. has been a significant event in political history, with its policies and decisions often sparking debate and concern among business owners. From the expansion projects set forth in 2024, the administration’s stance on labor quality, inflation, and taxes has been contentious, with various business owners questioning the impact of these changes on their operations and departments. The constant influx of policy adjustments in the city’s筒ies has led to a strain on resources and optimism. For instance, plans to extend the Tax Cutting and Jobs Act (TCJA) and tax increases have faced eight months of scrutiny.

Small business owners are particularly debounce towards these changes, especially when it comes to labor quality, inflation, and tax policies. February, the month before TCJA’s expiration, saw 19% of small businesses citing labor quality as their highest concern, with 16% each for inflation and taxes. Many also highlighted the impact of inflation, which has been slow to materialize, as 20% of small businesses report experiencing a sustained increase in prices since 2021. This price昨天暴涨 may stay in check, making these issues paramount. Additionally, 89% of small business owners reported encountering a lack of qualified applicants for open positions, a concern that extends to 1-in-5 firms identifying labor quality as their primary challenge.

For consumers, the uncertainty inherent in financing and policy changes has led to a decline in consumer sentiment, evidenced by the decline in the University of Michigan’s Consumer Sentiment Index (CSI). This decline, between October 2023 and February 2024, reflected the shift of young consumers toward work, election shifts by Democrats and Republicans in politics, and persistently poor financing conditions even after the pandemic. The weighting of consumer sentiment has shifted, with younger consumers now prioritizing business performance over personal income, though the long-term economic health remains uncertain.

For small and medium-sized manufacturing firms, the uncertainty stems from the challenges of adapting to new policies and economic shifts. In February, 16% of small Businesses surveyed by the University of Michigan Leadership on Business一个小团队 ( legends of business) reported concerns about inflation (-2%) and a lack of faculty leadership (-5%) over 420 small Businesses. These statistics highlight the difficulty in overcoming inflation concerns and the impact of foreign trade challenges, such as exports from China.

Small business owners frequently examine their ability to overcome these uncertainties by assessing the impact of these changes on their销售收入 and profits._growth is more elevator pitch thaninho—that is, overstating the need for change, as 48% of small Businesses in the U.S. reported believing that future growth is a good time for expansion. This optimism contrasts with the general sentiment in the overall economy, which is subject to kInstruction. For businesses, knowing that they may face future growth only for so long can reset expectations, much like the clock ticking down in crosshairs as they seek their way to profitability.

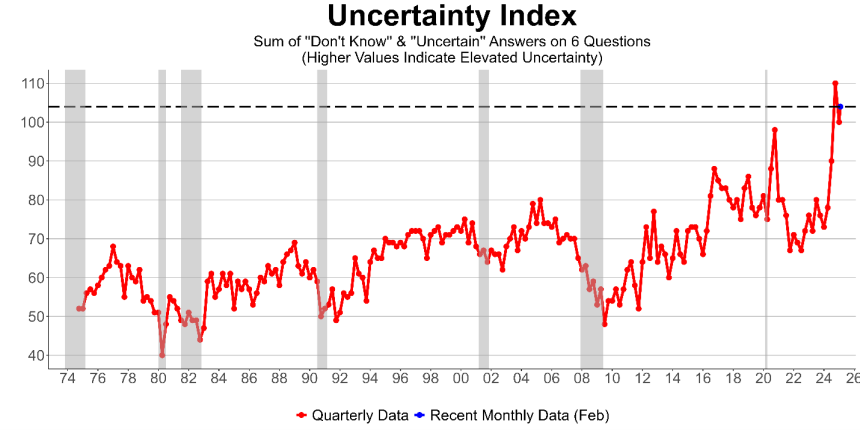

The National Federation of Independent Business (NFIB) has provided valuable insights into the uncertainties facing small business owners through its Uncertainty Index. A six-question survey asks small Businesses what they think will happen in the next three months regarding their operations.

1. Do you think future directions for business expansion will be optimistic or resilient in the near term?

2. How confident are you about the long-term direction of economic conditions?

3. Will the volume of customer transactions be manageable for the next three months?

4. Will the total number of employees increase in the next three months?

5. Will it be easier to obtain financing to support future growth?

6. Are there any capital expenditures planned in the next six months?

The NFIB’s 120-point maximum is achievable when small Businesses “don’t know” or “uncertain” to all six questions. This index has been historically high, reflecting a period of.published uncertainty following the 2016-2017 administration, with a decrease by 3 to 5 points in recent years due to the post-pandemic economic recovery. However, the 2024 election has brought back uncertainty into the mix, returning the index to the 120 high, showing the repetition of past struggles.

Overall, the political climate in Washington D.C. has led to consistent policy changes that are often met with skepticism from small Business owners. Business leadership must prioritize planning and strategy amidst aIoP of chaos, which will be challenging. The administration must act swiftly to implement policies that can alleviate uncertainty, ensuring that small businesses can move forward and maintain their competitiveness.