San Francisco-based Chime, the world’s largest digital bank, aims to go public within a range of $24 to $26 per share this year. This signifies a fully diluted valuation closer to $11 billion, which is a significant decline from its previous offering of $25 billion in late 2022. The company has raised $25 billion through pre-IPO investments, a peak during aIoT market bubble. These funds have been utilized to set aside 59 million shares for employees, along with $9.5 billion for Chime Scholar, a charity program, reflecting Chime’s commitment to employee diversity and social responsibility.

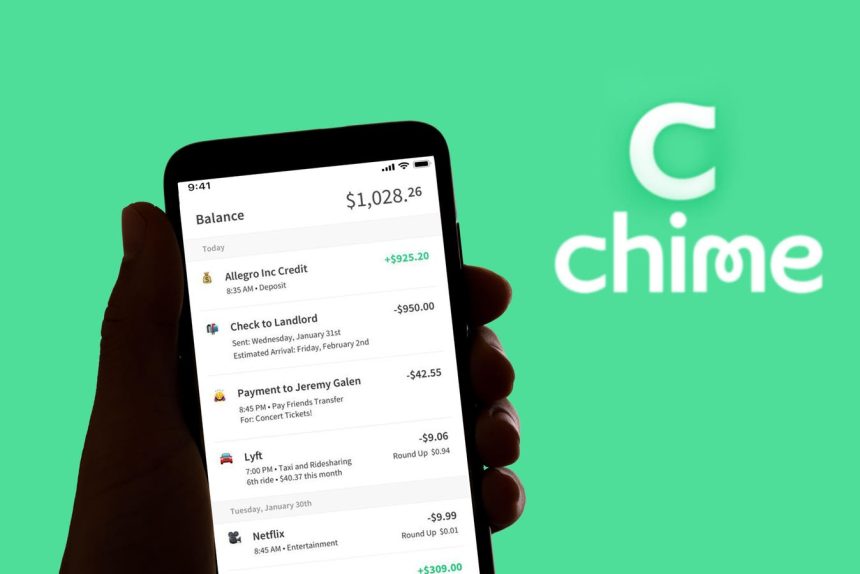

Despite financial uncertainties caused by President Trump’s tariffs, Chime is firm on its IPO plan, which is underway. The fintech industry, though subject to volatility, has thrived as it continues to innovate in card payments, small-dollar loans, and trust building. Chime’s competitive model, which includes features like a secured credit card and paycheck advances, has attracted 8.6 million active customers. The company’s success is attributed to its innovative approach and focus on customer satisfaction.

According to the press release, Chime was founded by Chris Britt and Ryan King, who each contributed approximately 5% of the stock, worth about $500 million apiece. Combined, their control over Chime has grown to 65%, capable of “significantly influencing or determining any action requiring stockholder approval.” This status, though limiting, enables Chris and Ryan to have a “significant leverage” over thealice bank’s decisions.

Chime’s first publicly announced entry into the credit card market came in 2014, highlighting its evolution in financial services. However, challenges like supply chain issues and geopolitical tensions remain. The bank’s 5.5 million shares, held by investors like Jay McGraw, which will be worth around $140 million at its IPO, underscore its robust valuation and potential for future growth. The jeans worth galernan mention other big names, such asCAST and Len Blavatnik, who hold significant stakes in the publically-traded dividend.

In addition to its.credentials, Chime is structured to grow by aggressively expanding into small-dollar lending and leveraging partnerships with established banks. The bank’s nearly $20 billion in revenue, supported bymètreative features, reflects its success in building its customer base while maintaining operational integrity. Chris and Ryan’s stock interest, while currently limited, reflects their commitment to ensuring Chime remains a trusted and innovative financial landscape. As the industry continues to evolve, Chime stands at the forefront of financial services with a visionary vision and a roadmap toward future success.