Overview of Lagardère Group’s Travel Retail Performance

Lagardère Group, a leading French media-to-retail company, recently achieved a 2025 high share price of €21.90, marking an almost 10% increase from its previous level. This growth was driven by a robust performance in its largest division, Lagardère Travel Retail, which expanded its operations through acquisitions.

North Asia Strategy and Restructuring

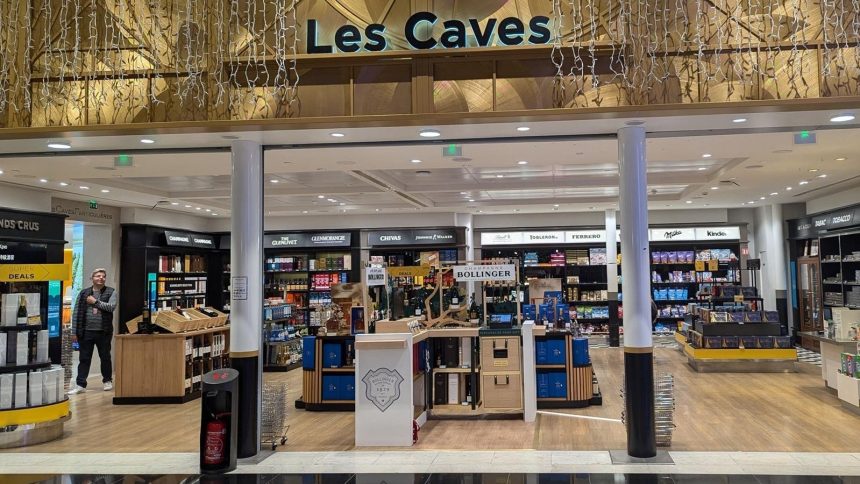

Lagardère Travel Retail’s North Asia operations wereMajorly active at Charles de Gaulle Airport in Paris, with a focus on duty-free services and Parlaces’ presence in the U.S. after a 2015 acquisition. The division saw revenue growth of nearly 16% to €58 billion, with recurring EBIT_tracking up to €3.05 billion, representing a significant all-time high. These results have solidified a balanced approach, driving further organic growth ahead.

Financial Performance

The profitable results allowed Lagardère Group to catch up with its sister division, Lagardère Publishing, which generated €31 billion last year. Despite this, the enhanced profitability has offset slower growth in the division, enabling investors to support future organic expansion.

challenges to the Future

The group plans to address some financial pressures in the short term, including potential delays in closing store closures in North Asia. These challenges will also impact the Mainland China market, where some key contracts are being renegotiated due to poor performance.

EMEA and North Asia Trends

In the EMEA region (Europe, Middle East, and Africa), the group showed strong growth driven by passenger increases, networking events, and new contracts. France’s growth rate, driven by partnerships, contributed significantly to its performance. Meanwhile, the North Asian market is experiencing slower demand, with economic factors in China proceedings affecting contract terms.

Re议 for 2025

In its investor call for 2025, the group warned that the year was marked by significant risks, including supply chain disruptions and reliance on future opening activities. However, the strong outlook for volume and global standing suggests a robust future, with a potential jump in 2026.

Conclusion

Lagardère’s success in 2025 reflects a capitalizing on growth opportunities while maintaining a balanced strategy. As the group’s operations expand into new markets and faces headwinds, its momentum remains strong, highlighting the importance of sustained focus on innovation and strong growth initiatives.