Intel’s abrupt announcement of CEO Pat Gelsinger’s retirement after less than four years was quickly followed by reports indicating he had been pushed out by the board of directors. Initially heralded as the leader to restore Intel’s past glory and manage an ambitious turnaround plan, Gelsinger’s departure raised questions about the company’s direction and the effectiveness of his strategies. Intel, once the leading computer chip maker, has struggled in recent years, missing essential technological advancements in mobile computing, experiencing quality control failures, and facing increased competition, particularly in the burgeoning semiconductor market tied to artificial intelligence (AI) and leading-edge chips.

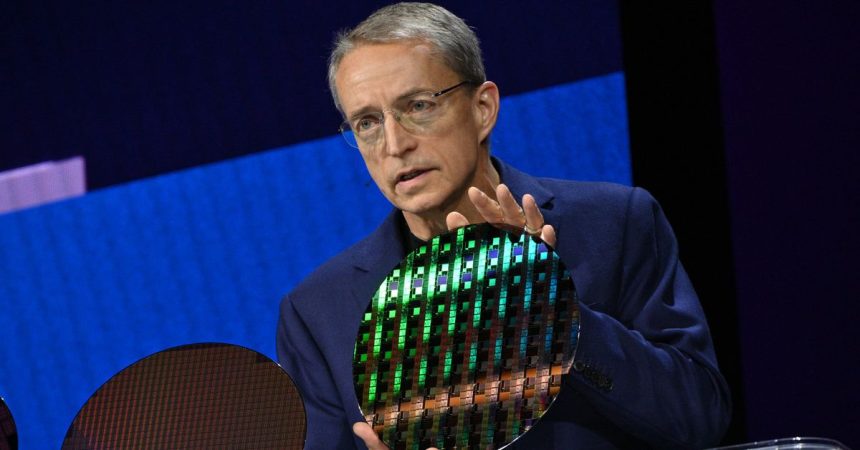

Gelsinger, a veteran of the company who joined at age 18, was known for his deep commitment to Intel’s culture and technical leadership, contributing significantly to landmark innovations like the 486 CPU. Upon his return to lead Intel in 2021, he viewed the company’s shortcomings, such as the missed opportunities during the mobile revolution and the failure to secure a position in the burgeoning AI sector, as critical issues to address. He pledged a bold recovery strategy involving political and corporate initiatives to regain market leadership by accelerating chip design and manufacturing capabilities. The plan included major investments in facilities and technology to produce chips at an unprecedented pace, aiming to finalize five new nodes in just four years.

Despite ambitious promises, however, Intel consistently met challenges that thwarted Gelsinger’s plans. The company made substantial financial commitments — tens of billions towards factories and technology upgrades — but, while the initiative was deemed “on track,” it came at a considerable cost. Layoffs, estimated to surpass 15,000, significantly affected employee morale, and internal assessments indicated that spending on future technologies may have come at the expense of immediate product quality. This dichotomy appears to reflect a strategy struggling to balance operational recovery with the urgent need for competitive product offerings.

Furthermore, as Intel grappled with its strategic pitfalls, it missed out on the rapid advancements in AI, an area where competitors like Nvidia thrived. While Intel had acquired promising firms and developed products aimed at high-performance computing, such as the Ponte Vecchio GPU, the architecture did not align with the market’s immediate demands for low-precision operations. Coupled with internal challenges like product integration and a focus that strayed from market-relevant designs, these missteps positioned Intel poorly as demand surged across sectors aiming to capitalize on AI technologies.

As the company neared the end of Gelsinger’s tenure, deteriorating financial results and negative press fueled the board’s skepticism regarding his leadership. Despite a slight overall profit, Intel faced staggering losses quarterly, exemplified by an unprecedented $16.6 billion loss attributed significantly to restructuring costs. This financial landscape put him under increased scrutiny from both investors and market analysts, culminating in a decline in stock value and rising concern about Intel’s operational and product quality standards. The board’s decision to remove Gelsinger thus appeared rooted in a growing lack of confidence in his turnaround plan amid external pressures and economic inefficiencies.

Speculation following Gelsinger’s exit suggested deeper organizational strategies might be at play, notably discussions around potentially spinning off Intel’s foundry business. Such a significant shift would align with moves seen in rival companies like AMD but would encounter numerous regulatory and operational hurdles, especially given Intel’s current government funding commitments under the CHIPS and Science Act. Amid these uncertain times, the need for robust strategic execution in semiconductor manufacturing remains critical not only for Intel but also for securing the United States’ technological autonomy in an increasingly competitive global market. In summary, Gelsinger’s departure underscores Intel’s pressing need for clarity in leadership and direction amidst a rapidly evolving semiconductor landscape where it has fallen behind.