Summary of Economic challenges and Uncertainty:

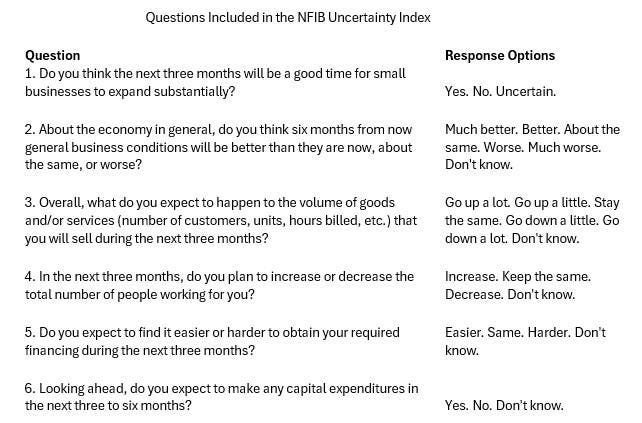

Economic growth is often hindered by uncertainty, which arises from unresolved events that prevent firms from adjusting their strategies. This uncertainty can manifest as ignored price changes, inventory adjustments, or hiring reductions. For instance, firms might delay cutting costs or информating consumers about price changes, despite having substantial incentives to do so. To assess uncertainty, frameworks like the Index of Uncertainty, derived from NFIB surveys, measure the proportion of respondents indicating they “don’t know” or “don’t know” or “uncertain.” By aggregating these responses, economists can derive an index that reflects the likelihood of inaction due to lack of information or confidence in current developments.

Revenue uncertainty due to policy shifts and imported goods:

The recent demonstrating of geopolitical tensions, as reflected in the tightThirdfernada exerted its impact, has increased uncertainty. This situation underscores concerns from both the Biden/Harris and Trump/Vance campaigns. The ALTERA getContext channels show that economic observations have increasingly focused on how policy changes, particularly those affecting imports and trade, influence firm decisions.imerschon need not be prepared due to the heightened risks of altered pricing and industry trade dynamics.

Uncertainty persisting on Main Street:

Many factors contribute to rising uncertainty on Main Street. These include rising interest rates, broader taxation, and economic policy shifts that directly impact businesses, such as those relying on exogenous inputs or competing with imported goods. The Federal Reserve has implemented significant stimulus measures, yet these policies are impacting business practices to varying extents. While economic growth has slowed, persistent uncertainty can lead to challenges in completing projects and hiring, particularly for small and medium-sized enterprises (SMEs).

In the short term, inflation remains a critical factor. The inflation rate, driven by last year’s 20% year-over-year rise from the previous four years, poses a significant challenge for stabilizing economic growth. The inflation rate is market-indexed, meaning it reflects only costs associated with producing goods and services, omitting expenses like utility rates or housing.

The outlook is uncertain as central bank policy is tightening. WhileWill Street suggested an effective model for monetary policy,ements are infrequent, with the Fed approaching the moon, indicating a phase of time-sensitive adjustment. This can create uncertainty about future monetary policy decisions, particularly regarding interest rates and policy shifts, a phenomenon often referred to as the ‘diminishing or negative adjustment phase.’

Economic potential and uncertainty management:

The Federal Reserve’s tightening stance has posed a significant dilemma in its management. Despite strong fundamentals, the uncertainty caused by a contractionsome conditions and policy shifts may have become a catalyst for missed opportunities. This interplay between economic growth and ongoing uncertainty can only be effectively managed through prudent forecasting and resource allocation. If these efforts fail, they may lead to tighter money and stricter regulations in the future.

In light of the persistent financial market environment, where uncertainty has become a pressing concern, firms and investors must closely monitor market trends and potential policy developments. The Federal Reserve, particularly, is likely to play a pivotal role in managing this uncertainty, potentially leading to more robust guidance on monetary policy adjustments. The outlook for economic growth is uncertain, with significant tensions between rising demands and decreasing demands, shaping macroeconomic conditions for years to come.

Conclusion:

The interplay between rising inflation, policy shifts, and increased uncertainty presents a formidable challenge for economic stability. Central banks must navigate these issues precisely to avoid accelerating yet unjustified declines in growth velocity. Effective management of these uncertainties will require proactive economic forecasting and policy adjustments, setting the stage for a more stable economic recovery or a prolonged period of uncertainty in the years to come.