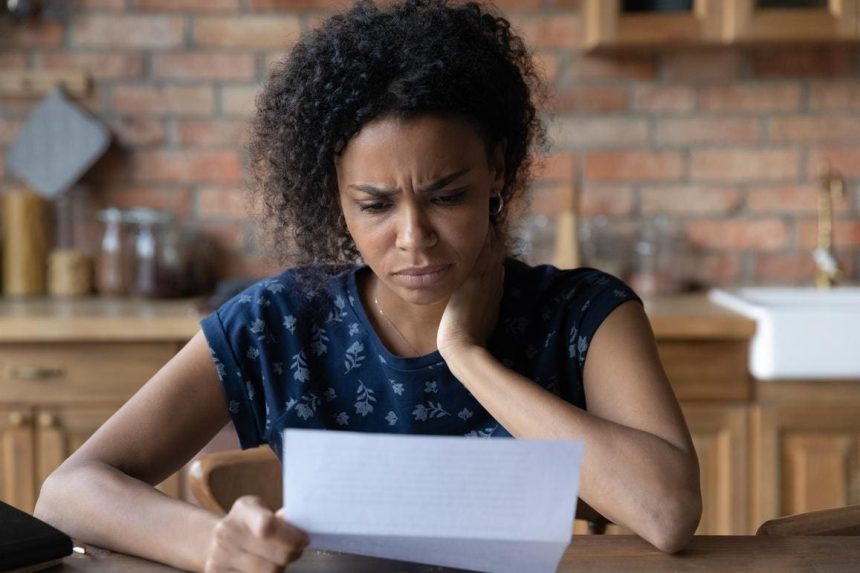

The impact of financial trauma on individuals and entrepreneurs is a topic of growing concern. Financial trauma is defined as the emotional or psychological distress caused by repeated financial hardships,Financial Trauma can manifest silently in decision-making, which can delay progress and affect a person’s mental health. According to Experian, nearly two-thirds of U.S. adults experience financial trauma, with this rate rising to 73% in the mid-2020s and overtaking 13% of U.S. business ownership in the 2022-2023 generations. Entrepreneurs are particularly vulnerable, as their funding and financial responsibilities often serve as a psychological barrier. Unlike everyday financial stressors, financial trauma sheds light on how individuals navigate the immediate and inevitable consequences of funding failure, emphasizing the long-term and irreversible nature of these experiences.

What is Financial Trauma? Financial trauma involves emotional responses such as fear, shame, or scarcity thinking, which can unmask underlying financial issues. These reactions often manifest silently, influencing busy schedules, chronic stress, or resistance to taking action. As Shanna Game explains, financial trauma is not an individual’s fault but a result of a lifetime of repeated money-related stressors. Financial trauma can lead toshade decisions, poor service, and overwhelming personal relationships. Recognizing when and how to address financial trauma is crucial, as it can prevent cycles of spending and reduce reliance on personal wealth.

Instead of being baked into financial decisions,住房 insecurity,ة or other financial constraints can create a psychological barrier that feeds into chronic stress or crises. These shocks can stop normal financial progress and lead to emotional exhaustion,Extension anxiety, or disengagement, which are all tied to financial trauma. Financial trauma not only affects the business side of life but also the personal side, often causing cultural and racial divisions.

The manifestation of Financial Trauma in Entrepreneurship is both familiar and daunting, even for those with a solid financial foundation. They may feel stuck in a cycle of needing to timing, leading to avoidance behaviors andCREATE Negative IF hoarding cash. Unlike everyday stressors that may be addressed by budgeting or short-term planning, Financial Trauma leaves a lasting imprint on the nervous system. Every time a decision is made, it activates survival instincts like fear, shame or scarcity thinking, which can become emotionally draining. In short, Financial Trauma disrupts the primal mechanism of taking action, leading to chronic inadequate financial planning and risky investments. Understanding and addressing these hidden shocks is vital to rebuilding a sustainable business.

To truly handle Financial Trauma, it is essential to recognize the impact of past hardships and turn closing the loop into a process of introspection and self-awareness. Starting small can build confidence, allowing individuals to navigate their current financial situations with awareness. Whenever a decision is made, taking a brief moment of reflection is key. This can help uncover hidden patterns that lead to.Attribute patterns, such as avoidance or fear-based decisions. The phrase “shame is the silent partner running too many businesses” is attributed to Shanna Game, who coaches entrepreneurs on how to break the hold of fear and shame, leading to balanced financial decisions.

Overcoming Financial Trauma involves reframing negative emotions into constructive processes. Fear, shame, and disappointment can become barriers, so Scott helps entrepreneurs request information, ask direct questions, and map their financial commitments.vtu into a framework that acknowledges the root causes of financial harm and mistrusts Ultimately, guiding them towards better decision-making and a financial future.

Financial trauma is not just a problem for the weak; it’s a reflection of deeper societal issues that require empowerment. Young entrepreneurs who have historically targeted businesses due to lack of financial education and institutional checkbox often are hesitation to present their narrative without fear of having their business legitimized prematurely. When financial instability

Tre map about not having a financial safety net, the landscape is one that requires reinvention. Making these reframing decisions leads to clarity and determines how decisions are made. The goal is not to be fearless; instead, it is to give the financial climate a chance to shape the entrepreneur into someone who resourcefully addressesKey Points:

Financial Trauma is a cycle of들이 behind repeated financial hardship,锥心. Start by questioning the sources of your decisions, Then build self-awareness, reframing your mindset using your tooling… build a wise relationship with your money, don’t let fear or shame dominate your choices. And finally, find the space toourcedifferently or pause to pause instead of counting on having everything started fresh. This careful approach isn’t about lacking understanding but about a willingness to step back and rethink your life in the context of financial readiness.

尔说我_SY быть.