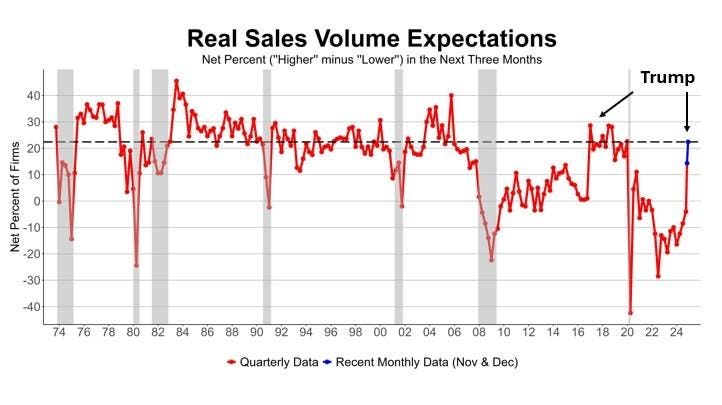

The period leading up to the November 2024 election was marked by profound pessimism regarding real sales growth. A net -18% of businesses anticipated higher real sales in August 2024, signifying a dominant expectation of decline rather than growth. This negativity had persisted for 34 months, reflecting a prolonged period of economic uncertainty and apprehension. The pervasive negativity suggested a lack of confidence in the prevailing economic conditions and potentially a cautious approach to investment and expansion. This extended period of negative expectations likely contributed to a sense of stagnation and contributed to the overall economic climate. The drivers of this pessimism could have stemmed from various factors, including lingering effects of previous economic downturns, global economic instability, or domestic policy concerns.

The November 2024 election, however, catalyzed a dramatic shift in sentiment. Immediately following the election, the net percentage of businesses expecting higher real sales surged by 18 points to reach 14%. This rapid turnaround in expectations underscores the significant influence of political events on business confidence. The positive momentum continued into December, with the net percentage climbing further to 22%, marking a remarkable recovery from the pre-election gloom. This positive shift suggests that the election outcome instilled a renewed sense of optimism and potentially signaled a more favorable economic environment under the newly elected administration. The rapid and substantial change indicates a potential turning point in the economic outlook.

Historically, from 1982 to 2008, the average net percentage of businesses expecting higher real sales stood at 22%, aligning with the post-election optimism in December 2024. This historical context suggests a return to a more typical level of confidence, potentially indicating a stabilization of economic expectations. However, the period following 2008 witnessed a significant deterioration in sales expectations, turning negative in 2008 and remaining volatile during the subsequent years. This volatility reflects the impact of economic challenges, such as the financial crisis and the COVID-19 pandemic, which significantly impacted business confidence.

A closer examination of sales expectations across different industries reveals a mixed picture. The manufacturing sector emerged as the most optimistic, with a net 34% of firms anticipating improved real sales. This optimism is particularly noteworthy considering the sector’s underperformance in recent years, suggesting a strong desire for growth and a belief in a fresh start. Similarly, firms in the finance and real estate sectors displayed comparable levels of optimism, likely driven by expectations of stabilized financial markets and potentially increased investment activity. The two services sectors also projected positive sales growth, although their outlook was less exuberant than manufacturing and finance.

In contrast to these optimistic sectors, several industries continued to harbor negative sales growth expectations. The construction, transportation and communication, and agriculture sectors all maintained a pessimistic outlook, potentially reflecting specific challenges within these industries or a slower response to the post-election optimism. The trades sector exhibited a balanced perspective, with roughly equal numbers of owners anticipating sales improvements and declines, indicating a degree of uncertainty within this sector. This divergence in expectations highlights the uneven impact of the election outcome and underscores the importance of industry-specific factors in shaping business sentiment.

Overall, the post-election landscape presents a mixed bag of optimism and caution. While certain sectors, particularly manufacturing and finance, responded positively to the election results, others remained apprehensive about future sales growth. The manufacturing sector’s optimism, despite its recent struggles, points towards a potential resurgence driven by anticipated changes in economic conditions. The finance sector’s positive outlook likely stems from expectations of greater financial market stability under the new administration. As the new government solidifies its policies, businesses will gain clearer insights into the potential economic ramifications and their specific impacts on various sectors. This clarity will play a crucial role in shaping future investment decisions and ultimately determining the trajectory of economic growth.