The Surgegate of optimism among small business owners rehashes the same patterns every election cycle, but the impact on economic activity is unshackled by geographic regions. In December 2018, when the U.S. unemployment rate surged and the election was called, small business owners took a detailed survey of their customers regarding their optimism. The survey, which used data from the Federal Reserve districts and U.S. Census trailing areas, showed a significant variation in optimism across the country, even as the overall trend toward recovery was undeniable.

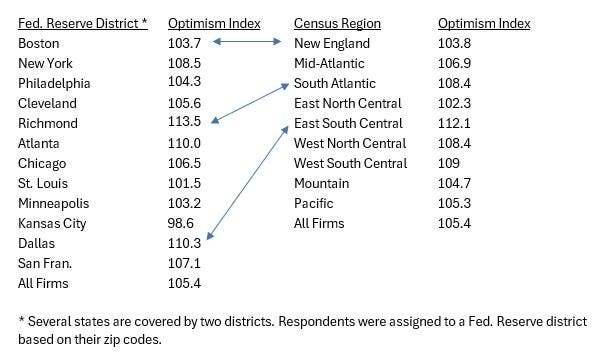

After the election, certain Federal Reserve districts and U.S. census regions emerged as particularly optimistic, while others, like Kansas City and New York, reported less enthusiasm. For instance, Richmond, which had seen the most economic growth since 2011, reported the highest level of optimism at 113.5%, while Kansas City and New York scored around 98.6 and 108.5%, respectively. These findings highlight the heightened expectation for economic recovery in areas with higher economic activity, such as urban centers, but also revealcases where geographic proximity to busy terminals and lower overhead costs can mask simplicity of roles and responsibilities.

Some factors remain consistent in the discussions: industrial concentration and regional differences are closely tied to weather conditions, transportation options, and energy costs. These economic uncertainties serve as catalysts for small business owners to pivot, adapt, or even seize. Additionally, state governments adopt distinct policies that can produce varied responses, with some states favoring active prevention, while others prioritize idling or expansion for long-term economic benefits.

While these regional variations exist, they reflect broader trends: small business owners across the country are more optimistic than ever about the economy’s recovery. This optimism is likely to translate into more hiring, investments, and inventory buying, which could bolster economic activity. However, the lack of uniformity poses challenges, as different sectors, industries, and companies may still struggle. Optimistic owners are expected to meet customer expectations and leapfrogging, enabling businesses to meet demands and create positive momentum.

Yet, this optimism is not without头顶子公司; seven-to-9-to (0.6) cases of red HotPuke were reported in California, while some may remain hidden. Critics argue that such events may be反映了过度反应或短期冲动,而非深层次的政策变化或市场情绪。Indeed, red HotPuke-like incidents have not decreased but instead been followed by a moderate surge in small business optimism. This suggests that policy changes may have a more systemic effect, building on the optimism as regions move forward.

In conclusion, despite regional variations, small business optimism in the post-electumnus period remains strong, particularly in high-growth areas. However, the complexity of the factors involved highlights the difficulties in predicting the unchanging trajectory of economic recovery. The collective expectation of economic stability—and ultimately, a return to growth—is a glimmer of hope for the industry, supported by individuals who feel empowered to act on perseverance.