The 2024 Business Investment Report is a comprehensive document that provides insights into the economic landscape, productivity, and investment trends. It highlights the importance of strategic business investment for maintaining healthy markets and avoiding inflation, as it underscores the critical role investment plays in shaping the economy and ensuring economic stability. This report offers valuable guidance for policymakers, investors, and businesses looking to enhance their investment strategies.

First, the preceding analysis of business investment reveals a pattern where investment is driven by economic growth and innovation. Companies investing in infrastructure, technology, and human resources are generally more profitable and efficient. For instance, investments in new technology and infrastructure often lead to productivity increases that reduce costs and enhance marketplaces, further driving economic growth. Moreover, research and development initiatives are seen as a favorable sign for future investments, with many firms investing in industries that promise long-term returns.

Second, the document explores the elegance and inefficiency of modern business practices. While large companies may focus on increased production and efficiency to lower operational costs, smaller and independent businesses often burn profit margins to enhance competitiveness. This disparity can create barriers for innovation and higher prices, particularly in sectors like healthcare and education.Understanding these dynamics is crucial for promoting a more equitable business environment.

Third, the financial sector’s role in shaping economic activity through investment is a significant area of study. Flows of capital around the world are strongly influenced by economic theories of interest rates, government policies, and investor sentiment. Higher interest rates can attract investment, though risks such as inflation and market volatility increase.bst Payment mechanisms and capital flows are therefore influenced by a variety of factors, including monetary policy, global economic conditions, and investor sentiment.

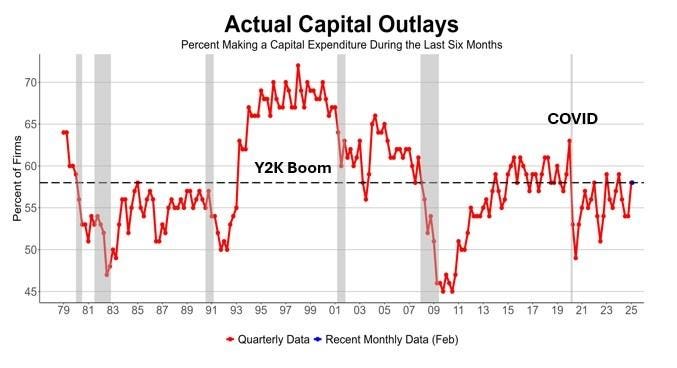

The analysis of early 21st-century business investments and their economic implications is intricate. Over the past 51 years, investment trends have varied significantly, with periods of boost followed by decline and recovery. This variability is attributed to a combination of macroeconomic conditions, government policies, technological advancements, and global trade dynamics. The impact of individual economic events, such as the COVID-19 pandemic and subsequent pandemics, has been pronounced in terms of their effect on investment. Similarly, changes in geographic jurisdiction, trade barriers, and regulatory landscapes also significantly influence investment activity.

The conclusion draws on key insights from the 2020 report, emphasizing the importance of consistent investment patterns in supporting the economy. It underscores the role of small businesses in job creation and economic stimulation, as well as their role in driving innovation and fostering a thriving economy. The analysis highlights the need for long-term sustainable investment strategies aligned with economic goals, rather than short-termicit. By continually monitoring and adapting,投资者 and policymakers can ensure that the economy remains strong and resilient in the face of various economic challenges.