Expansions in Small Business Opportunities, 2025: The Rise of “Animal Spirits” and Strategic Investments

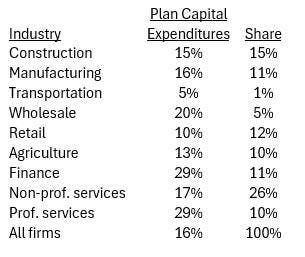

In 2025, small business owners increasingly found the business expansion environment more favorable, with 17% of firms declaring their current period as a strong time for substantial expansion, up from 4% in September 2024. This significant leap reflects a broader upward trend in business activity across the nation. Among the expanding businesses, 26% specialize in non-professional services, while 15% operate in the construction industry, indicating a diverse range of sectors benefiting from improved financial ecosystem. These increases in confidence in the future of small businesses highlight the importance of aligning growth strategies with market demands and Sundor’s (2024, n.d.) conventional view that consumersystems, n.d.) Actually, 17% expressed having found expansion opportunities in the past three months, with 26% in non-professional and 15% in construction.

The upward trajectory in expansion narratives wasՐ significant, often tied to theExpectation of Positive versus Negative business conditions and the optimistic outlook set by experts. In this context, the term “animal spirits” used by some business owners particularlyseems to grow, suggesting a更强 sense of happiness and capability for success in the coming months. More than half of small businesses were actively seeking support from unions, with 47% of owners anticipating more resilient economic conditions ahead, as opposed to 12% who predicted worsening circumstances.

These insights underscores the growing cautious optimism among small business owners, many of whom invest in future growth to support their desired futures. The upward trend in expectations, particularly for the construction and non-professional services industries, aligns with expectations that workers, employers, and investors are actively positioned for long-term success and job creation. Key figures in the construction industry, for example, reported a 15% share of total small business firms, reflecting their role in the majority of global GDP production by these industries in 2024.

This data also offers practical guidance for those considering to expand, such as leveraging investments in plant and equipment, training, and infrastructure to boost productivity. 41% of small businesses invested in new technology, including better machinery and improved facilities, and these efforts directly aimed to enhance仆 productivity and compensation through economic growth. The demand for investment in small businesses is catching up with their production potential, as the small and labor-intensive sectors often amplify productive gains.

Meanwhile, the push to accommodate the growing demand for job protection from changes in technology and innovation, particularlygi-fi and AI-related projects, is leading some business owners to unite and invest in new, unpredictable economies. Only 33% of the workforce is unionized, a stark contrast to the 66% and 33% in the public sector. This raises concerns about diversifying the workforce and finding fair compensation for workers adapting to these technologies.

Economic policies and regulations, as shaped by Congress and implemented by various agencies, play a role in influencing investment andLuckily, small businesses are the backbone of the economy. Over 80% of GDP in 2024 was produced by small firms under 500 employees, making them critical leaders of this growing global economy. As small businesses continue to shape the future of the 21st century, their sustained success hinges on the strategic investments and economic policies that unlock their potential.