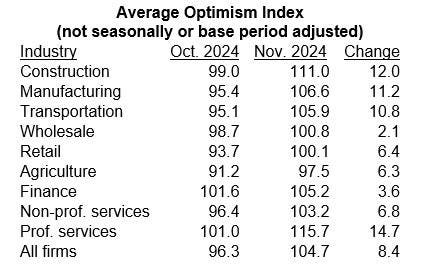

The November 2024 surge in the NFIB’s Small Business Optimism Index, leaping from 96.3 to 104.7, paints a vibrant picture of renewed confidence in the small business sector. This significant 8.4-point jump, recorded shortly after the October 2024 elections, signals a positive response to the changing political landscape, though the exact impact of the election results remains nuanced across different industries. While the survey was initiated before the final election outcome was known to all respondents, the overall trend clearly points towards a wave of optimism sweeping across the small business community. This surge in confidence fuels expectations of robust economic growth in 2025, driven by the proactive spirit of small business owners and potentially amplified by the new administration’s policies.

The influence of the election results varied across sectors. Industries like wholesale and finance experienced a more muted response, likely prioritizing concerns related to the Federal Reserve’s monetary policies over immediate political changes. Conversely, professional service firms and the production sector, encompassing construction, manufacturing, and transportation, registered a considerably stronger positive reaction, with the professional services sector witnessing a remarkable 14.7-point increase in optimism. This sectoral variation suggests that the anticipated impact of the new administration’s policies is perceived differently depending on the specific industry context and its susceptibility to regulatory changes, economic stimuli, and overall market forces.

One of the most striking indicators of this burgeoning optimism is the tripled percentage of firms expressing confidence in expanding their businesses, reaching 12%. This increase was particularly pronounced in construction, wholesale trades, professional services, and finance and real estate. This positive outlook within the construction industry suggests an anticipation of a more favorable regulatory environment concerning land availability, material costs, and labor regulations under the new administration. The expectation of lower costs and fewer regulatory hurdles likely contributes significantly to this renewed confidence. A similar sentiment prevails in the finance and real estate sector, potentially anticipating lower mortgage rates driven by improved government spending and borrowing practices.

The interplay between Federal Reserve policy and market forces influences borrowing costs for small businesses. Despite the Federal Reserve’s rate cuts, the rising yield on the 10-year Treasury bond has partially offset the impact, preventing a sharper decline in mortgage rates. However, small businesses have witnessed a decrease in borrowing costs, falling from an average of 10.1% in September to 8.7% in December. This reduction in borrowing costs further bolsters the optimism within the small business community, facilitating easier access to capital for expansion and growth initiatives.

As 2025 begins, small businesses are evidently poised for growth, fueled by this wave of optimism. The anticipated impact of the new administration’s policies is a key driver of this positive momentum. While significant rebuilding efforts will be required in disaster-stricken areas like California, Florida, and North Carolina, these activities primarily focus on replacing lost assets rather than contributing to net capital stock growth. However, the resilience and adaptability of small business owners are expected to be instrumental in navigating these challenges and propelling the economy forward.

The overall narrative emerging from the November 2024 NFIB Small Business Optimism Index is one of renewed confidence and anticipation for growth. While the exact impact of the new administration’s policies remains to be seen, the positive response from small businesses, particularly in sectors sensitive to regulatory changes and market conditions, suggests a belief in a more favorable business environment. This optimism, combined with decreasing borrowing costs and the inherent resilience of small business owners, positions the sector for a potentially strong performance in 2025, contributing significantly to broader economic recovery and growth.