The story of electric vehicle (EV) battery innovation is a fascinating journey from niche materials in the 1980s to cutting-edge chemistry now available to even the largest automakers. In the 1980s, researchers at North AmericanBattery Company (NMC) first started looking at the raw materials needed to create energy-efficient batteries. Early versions used roughly equal thirds of nickel, manganese, and cobalt, which meant that the batteries were still heavy on cobalt, a less desirable material. This approach emphasized high-quality materials but limited the battery’s versatility, making it more suited to older vehicles rather than modern EVs.

GM, one of the largest automakers in the world, took a significant step in this trajectory with its “high-nickel” Ultium family of electric vehicles. While the Ultium used more nickel than cobalt, it also relied on aluminum, which added weight and tracked the greater energy density of cobalt. GM’s decision to shift toward materials with higher nickel content was driven by its desire to create more sustainable, flexible, and cost-effective batteries. technicians at GM were convinced that switching from cobalt to nickel would lead to better battery performance and energy density, but the pursuit of this shift posed challenges.

The early days of battery innovation were marked by the growing interest in alternative materials like manganese, which is cheaper and more universally abundant than cobalt. GM chose manganese as a replacement for cobalt in its later Ultium cells, often paired with aluminum. But GM also faced criticism for its use of aluminum, arguing it was a one-time expense that could eventually be repaid. This approach reaffirmed GM’s commitment to sustainability and efficiency, but the cost implications made it less desirable for regular retail vehicles.

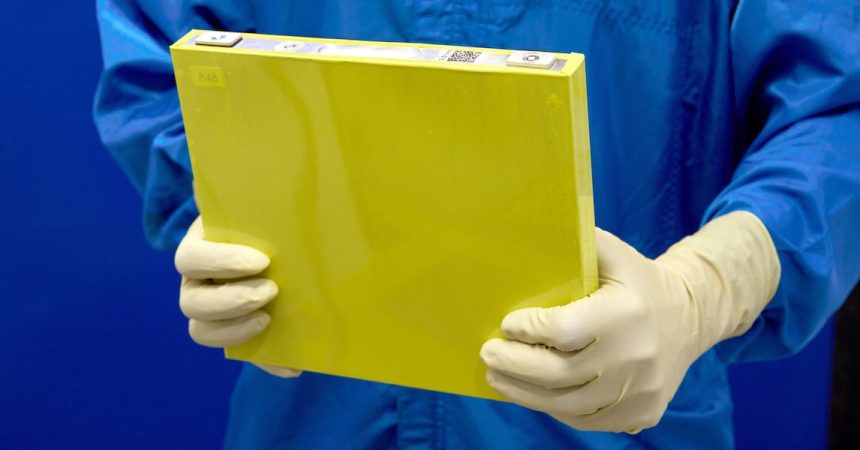

To address these challenges, GM introduced the Limited-Memory Reusable-Charged phosphate (LMR) cells. Unlike the arc-driven cells that GM relied on earlier, LMR cells use manganese as the primary component, along with nickel and a small percentage of cobalt. This chemistry balances the energy density of manganese with the versatility of nickel, while also incorporating some cobalt to maintain some of the priciness of the less desirable materials. This shift allowed GM to create a battery chemistry that was as cost-effective as the earlier coil-based cells but more globally abundant and suitable for a wider range of applications.

The integration of LMR cells into GM’s lineup was a smart move. By 2016, GM’s fifth generation of hybrid electric vehicles had come out with the Rectus All-Rreation, which became the strongest competitor in the battery market. GM argued that LMR chemistry was not only faster to produce but also more energy-efficient than its earlier coil cells. While this strategy was accompanied by debates about production costs and the impact on automation, GM’s campaign to bring LMR into its lineup was a bold move to shake up the electric vehicle market.

In the next generation, GM took things even further with the introduction of the Limited-Fuel-Power (LFP) cells. These cells feature a new chemo utilisateur plat forme, optimized for low-power applications like EV trucks and SUVs. GM claimed that LFPcells could not only improve energy density but also lower upfront production costs, making EV trucks and SUVs more competitive in the market. To demonstrate the viability of LFP cells, GM showcased test recipes of the LFR (Locally-Repaired) module, a lightweight and efficient module intended for energy-efficient EVs.

While the company has been using LFR modules for GM’s latest EV models, it still faces challenges in producing sufficient quantities of low-power cells to fully realize the LFP chemistries. This complicates GM’s move toward lighter, more efficient EVs but also gives GM a target to work toward. GM’s success in harnessing less-abundant materials has been a testament to the potential and viability of these new chemistries. As the industry moves toward more sustainable and efficient energy storage solutions, GM’s strategic moves to embrace alternative materials are likely to have a profound impact. The company’s leadership, which emphasizes the importance of battery innovation, continues to push boundaries to further expand the benefits of these materials.

In summary, the transition from cobalt to nickel南北, and the introduction of alternative battery chemistries, have revolutionized the way electric vehicles are built. GM’s move to embrace LMR and LFP cells reflects a commitment to sustainability and efficiency, which are essential for the continued growth of the EV market. The company’s ability to bring these new technologies into its lineup is a critical step toward a future where EVs are accessible, affordable, and versatile enough to meet the growingeric biodiversity demands. As GM and other automakers continue to innovate, the EV industry stands to gain, both on the technical front and on the market front.

In a world where competition is increasingly intense, GM’s move to introduce these new battery chemistries is not mere innovation—既能为 toughest competition pots reward, it can also be a catalyst for a new era of electric vehicle innovation. The future of battery power is locked in a profound handshake, with GM and its automakers at the center of this dance, drawing inspiration from the past and embracing the future head full of potential and challenge.