The discovery of a dark web operation trafficking in genuine facial IDs and accompanying identity documents highlights a concerning evolution in identity fraud. Unlike traditional data breaches that expose compromised biometric data, this operation appears to be actively soliciting individuals to sell their own identities for financial gain. This creates a “perfect storm” scenario for identity verification systems, as the combination of legitimate documents and biometric data makes fraudulent activity exceedingly difficult to detect using conventional methods. The operation underscores the vulnerability of Know Your Customer (KYC) processes, which are crucial for financial institutions in preventing fraud. This new threat necessitates a shift towards more sophisticated, multi-layered verification systems.

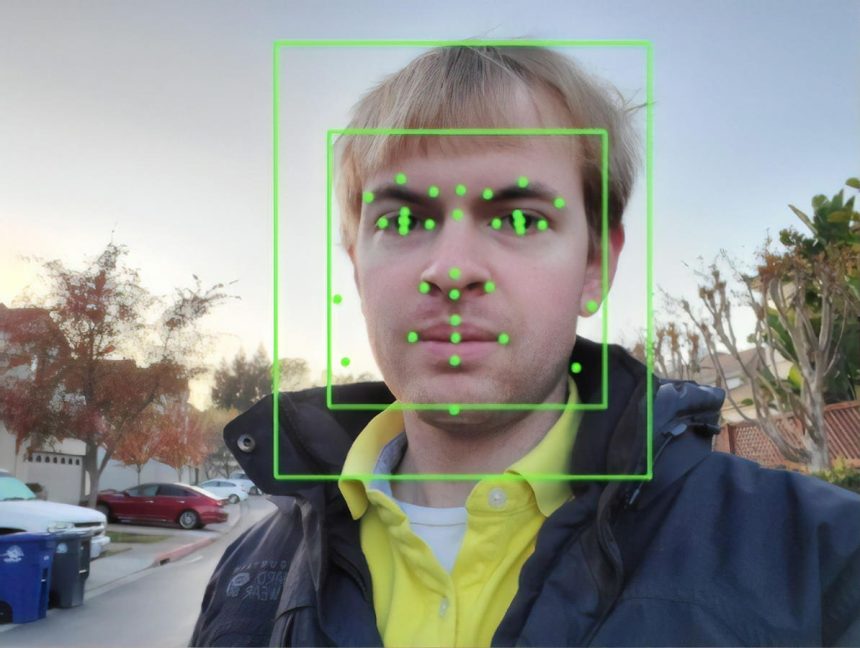

The attack process employed by criminals using this dark web resource bypasses traditional security measures at multiple stages. Firstly, document verification, which typically identifies forged or altered documents, is rendered ineffective as the criminals are utilizing genuine credentials. Secondly, facial matching algorithms, designed to compare submitted photos to ID documentation, are also circumvented due to the legitimate nature of both the image and the ID. Finally, even liveness detection, designed to prevent the use of static images or recordings, can be compromised by sophisticated techniques such as deepfakes, 3D modeling, and real-time animation. This multi-stage bypass demonstrates the increasing sophistication of identity fraud and the urgent need for enhanced security measures.

The willingness of individuals to sell their identities for relatively small sums of money is a particularly alarming aspect of this operation. While the short-term financial gain might seem appealing, the long-term consequences can be devastating. By providing criminals with complete identity packages, individuals are not only risking their own financial security but also enabling a wide range of fraudulent activities, from opening fraudulent bank accounts to committing identity theft on a larger scale. This highlights the need for increased public awareness regarding the risks associated with selling personal data, especially in the context of evolving dark web activities.

Mitigating this evolving threat requires a comprehensive, multi-layered approach to identity verification. This involves moving beyond simple document and facial matching and incorporating advanced techniques to confirm the authenticity and liveness of the individual. Such an approach should include verifying the match between the presented identity and official documents, analyzing embedded imagery and metadata to detect malicious media, and employing unique challenge-response mechanisms to ensure real-time interaction. Furthermore, integrating threat intelligence, continuous monitoring, incident response, and proactive threat hunting is essential to identify and counteract emerging threats effectively.

Beyond the specific dark web operation, the broader issue of bypassing biometric security measures requires urgent attention. Recent research has demonstrated how AI-generated deepfakes can successfully bypass facial recognition systems, including liveness detection, even without accessing dark web resources. This underscores the limitations of relying solely on facial biometrics for verification and reinforces the need for multi-factor authentication and more robust security protocols. The ability of deepfakes to mimic real-time expressions and movements highlights the rapid advancement of these technologies and the increasing difficulty in distinguishing between real and manipulated media.

The evolving landscape of identity fraud necessitates a proactive and adaptive approach to security. Financial institutions and other organizations must invest in robust, multi-layered verification systems that incorporate advanced technologies and threat intelligence. Educating the public about the risks associated with sharing personal data, especially in the context of online interactions and potential financial incentives, is also crucial. A collective effort involving technological advancements, robust security practices, and public awareness is essential to combat the escalating threat of identity fraud in the digital age. The short-term financial gains offered by these dark web operations pale in comparison to the potential long-term consequences for individuals who choose to participate. Protecting personal identity requires vigilance and a clear understanding of the evolving threats in the digital landscape.