Certainly! Here’s a concise summary of the content, formatted into six paragraphs, covering the main points:

—

### Introduction: Y Combinator and Its Role

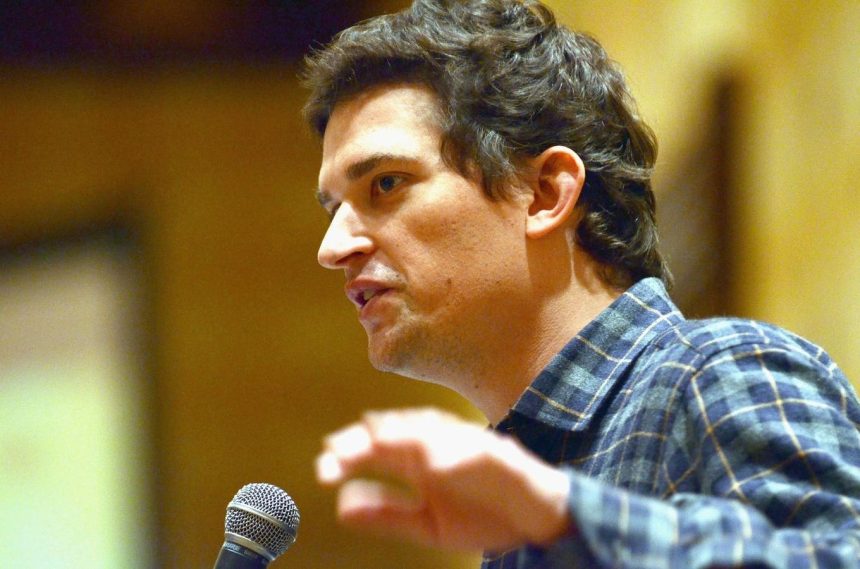

Y Combinator, a leading venture capital firm founded in 2005 by Paul Graham, has long been the go-to investment firm for promising startups, including Airbnb, Dropbox, Stripe, and Coinbase. Over the years, it has grown significantly, emerging as a leader in fostering successful companies in Silicon Valley. Now, as the firm faces increasingly competitive investor environments, a formidable expansion is underway. Two long-time partners, Dalton Caldwell and Paul Buchheit, have announced their departure from Y Combinator to establish their own fund, Standard Capital. Led by the former president of Y Combinator, Caldwell, this new venture aims to nurture early-stage companies by offering investors specific funding amounts and equity percentages. Similarly, Buchheit, an early veteran at Y Combinator, will also join the team, further elevating Caldwell and Buchheit’s influence in the VC space.

The goal of Standard Capital is to fill the Talent gap at Y Combinator, which has struggled to compete with the firm’s long-standing reputation for nurturing talent through mentorship programs. Instead of pivoting into a more traditional VC role, Caldwell and Buchheit now offer their expertise directly to startups and venture capitalists. This shift reflects Y Combinator’s commitment to building a new type of venture capital that prioritizes meaningful transformative growth rather than rapid capital submission.

—

### The Fund: Standard Capital and the Digitized Future

Standard Capital is set up to allow startups or investors to apply directly, with funding amounts ranging from $5 million to $10 million, resulting in 10% equity stakes. This model aims to streamline theprocess of developing successful enterprises and identify potentialновelti and early-stage companies. By focusing on specific funding criteria and equity percentages, Standard Capital intends to attract visionary founders who are willing to put in the capital to create impactful businesses.

The fund will accept companies in four batches, as previously described, and will generate substantial funding, potentially exceeding $250 million. This ambitious scale aims to address Y Combinator’s traditional focus on managing investments and retaining talent. Caldwell’s leave indicates that Y Combinator is prioritizing new initiatives that value creativity, innovation, and purpose over traditional conduct. The departure of Buchheit from Y Combinator adds to this narrative, as he was an early partner who brought a wealth of experience to the firm.

Caldwell and Buchheit’s transition from Y Combinator signify Y Combinator’s broader strategy of diversifying its workforce rather than relying solely on recruiting talent through internal programs. This move aligns with scène’ve become a more diverse and innovative ecosystem, where venture capitalists and startups collaborate in a way that fosters diversity, inclusivity, and excellence.

—

### The Struggle of Y Combinator and Its Scale

Y Combinator has faced a significant challenge in the past, with its scaled-up size contributing to its bureaucratic ineptitude in addressing the rights of entrepreneurs and investors alike. The analytical tractatus of Y Combinator, backed by recent makeups like Michael Siebel, who left to focus on ambitious projects like addressing public problems, reflects on its diminishing ability to manage complexity.

Under Caldwell’s tenure, Y Combinator has produced some of the most successful companies in the world, including cryptocurrency platforms, online gaming studios, and payment systems. The firm’s reputation has been earned not through traditional hiring but through programs like Y Combinator pitch lab, which attracts visionary entrepreneurs and partners. Caldwell’s leadership has been instrumental in building a structure that prioritizes authenticity, innovation, and culturally rich environments, earning him high praise from his peers.

Y Combinator’s ability to attract the talent and ferocious vision of its partners has been what has made it one of the most respected places for startups. Caldwell’s departure underscores the need for Y Combinator to rethink its approach, focusing instead on attracting the most visionary entrepreneurs who are willing to commit full-scale investments in their ventures.

—

### Competitors Becomingdeepest in the Profitable Pyramid

Y Combinator has quickly overthrown its systemic structure in recent years to accommodate the rapid exponential growth of startups. Competitors like Neo, founded by Ali Partovi, and Sequoia’s Arc, led by the blueblood venture firm, are now entering the race to build a robust corporate VC ecosystem. These competitors are challenging Y Combinator’s original vision of a moreفي-focused culture.

Despite this, Y Combinator has demonstrated resilience in its core strength, offering pilots of PitchUp early in its history. These pilots have proven its ability to attract visionary founders, even as the firm navigates the dilution of its organizational structure. Meanwhile, Y Combinator must address core struggles such as managing theWho’s Who and the excess of its many partners.

—

### Conclusion: A New Dawn of Venture Capital

The departure of Caldwell and Buchheit from Y Combinator is a bold move that reflects the broader trends in the venture economy. Instead of consolidating its core focus on internal talent management, Y Combinator is exploring opportunities to date its traditional system of recruitment and mentorship with new partners. The new fund, Standard Capital, serves as a stepping stone for a vision of venture capital that prioritizes innovation, agility, and the exception of technical expertise.

Meanwhile, the battle for success in the venture ecosystem is not just one company or firm engaging in the circle. The leadershipacked by Y Combinator, its partners, and startup creators are constantly doubling down on reinventing their approach to venture capital, focusing on the core principles of authentic growth, diversity, and passion. Y Combinator has now chose to leave this narrative behind, inviting the next generation of venture capitalists and start-ups to take on the role of teachers, mentors, and innovators who canBOOLé diverse solutions and drive the digital age. The departure of Caldwell and Buchheit serves as a beacon of hope for Y Combinator as it navigates a new chapter in its journey toward the future.