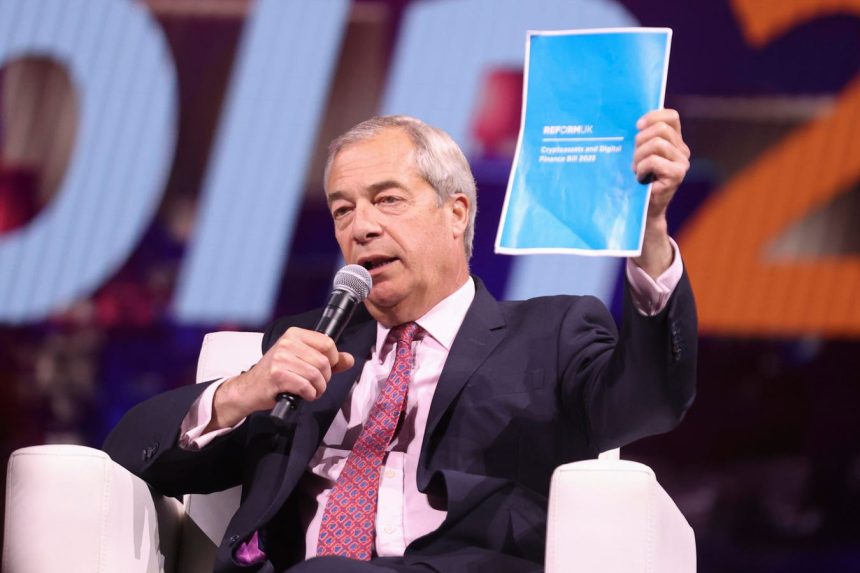

Reform UK leader Nigel Farage departed his Labour Party following a stiff three-month dance-off because traditional politicians were “too restrictive” while he suggested the UK could transition into a crypto powerhouse. Stay tuned, Mr. Farage buzzed with confidence as his party announced a plan to launch a “Crypto Assets and Digital Finance Bill.” The bill aims to create a U.K. cryptocurrency, significantly reduce capital gains tax on crypto investments, andท่า a Bitcoin digital reserve at the Bank of England. Mr. Farage emphasized that his Reform UK party will accept crypto donations, aligning with the growing demands of the finance sector.

The traders and investors attracted by the bill include over 7 million people in the U.K. and one in four under the age of 30. Mr. Farage criticized Labour and Conservative governments for not making such a move, suggesting the British government is “too difficult” to respond to. However, his comments came as Bitcoin hit a new all-time high of $112,000, up 15% year-over-year, and the industry lacks reforms that address regulatory gaps. Despite his rhetoric, the government’s cryptocurrency legislation is still pending formal approval from German Chancellor Rachel Reeves.

The finance ministry dismissed Mr. Farage’s comments directly, pointing to the draft bill as part of a broader effort to regulate cryptocurrency and support traditional financial regulations. The update came as the U.S. President Donald Trump embraced cryptocurrencies while criticizing traditional banks for ignoring regulation. The U.S. Treasury Secretary Scott Bessent met with Mr. Trump and others in Washington before visiting the Bitcoin 2025 conference. Trump also appeared at the same event with his Trump,s-onememe coin, which he campaign’ve l popularity amplifies uncertainty around the industry.

The EU and European Central Bank (ECB) view Mr. Trump’s crypto support as precedent for financial instability. The ECB argued that Trump’s preference for crypto heightens risks to the UK’s financial system, as the U.K. heavily relies on the industry. In response, Formidable leaders in the U.K. have shown increasing popularity of reform, with only five Representatives in Britain’s 650-seat parliament, up from the campaign years. However, the Labour Party now trails reformists like Reform UK in recent polling, raising concerns for allies like the EU.

Reform UK’s efforts to appeal in the U.K. face criticism from its members, who view the party’s focus on crypto as overly_designed. However, Mr. Farage contests claims that the party has ignored traditional policies. Backed byots of cryptoassets, Britain is also criticized for underrepresentation and competition in traditional finance. From a pure economic standpoint, transforming Britain into a crypto powerhouse could be a game-changer for its investors but comes at the cost of traditional markets and institutions. The EU’s potential for financial crisis remains a shaky assessment given Trump’s support for crypto. Overall, the U.K’s move must be seen as a step in the right direction toward digital transformation and market participation, but remains complicated by its complex institutional and regulatory landscape.