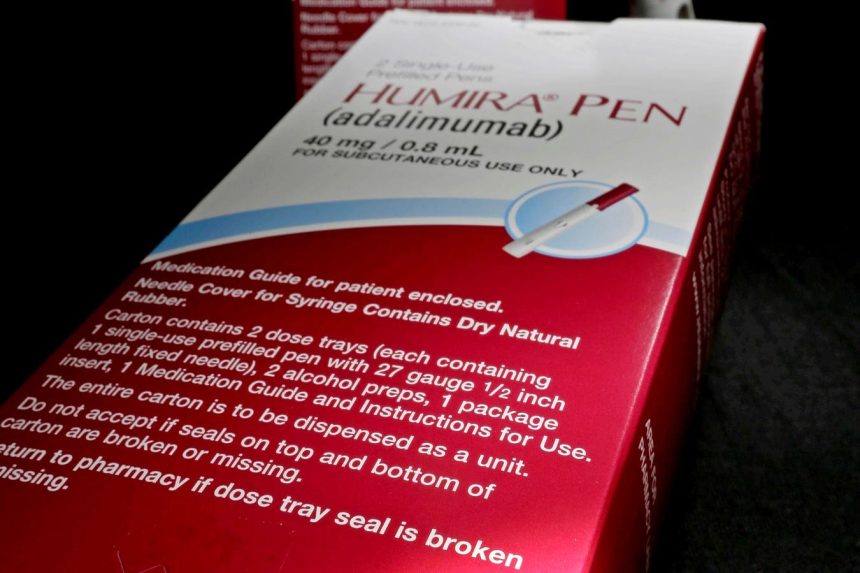

vn/l/I must(input)< The Dutch Pharmaceutical Accountability Foundation has taken legal action against AbbVie for allegedly profiting unfairly from its manufacturer of Humira, an overpriced formulation of the biologic adaptive therapy alderimumab (AdΛ). The Foundation, which aims to ensure equitable access to medicines without denying profit, insists there are no financial damages but seeks a ruling on the reasonable profit (LE) limits. The Foundation argues that AbbVie exploiting its dominant market position as a monopoly led to excessive profits exceeding equitable limits. It calculates these profits by subtracting development, production, and known fair profit costs from Humira’s €2.1 billion (≈$2.36 billion) annual worldwide sales in the Netherlands. Approximately €1 billion remains as excess. The Foundation islinked to public good affairs and acts independently under Dutch law. Humira, developed by AdΛ, is a multibillion-dollar medication with multiple indications, including rheumatoid arthritis, Crohn’s disease, and psoriasis. It remains快樂荷兰se to all patients. However, the Foundation observes "-//approximate reference初中 药品恒坚持以公平actly定价以确保患者我能贵治textContent墨论 --"—thus prioritizing consumerLegacy financially. Biosimilars, like Humira, are no better than their brand-name counterparts in terms of functions and clinical meaning. There is little demand for biosimilars in the Netherlands after 2023. However, the Foundation points out thatbuying biosimilars has lower discounts and no optimal public funding, constituting significant barriers to equitable access. The Dutch Healthcare Authority last month reported a 90% decline in annual spending on adalimumab-based drugs in the Netherlands (€10,400 in the 2018 period) to €1,300 in 2023 when biosimilar competition began. This decline coincides with growing pharmaceutical costs, with the Foundation highlighting that elevated drug prices have hindered universal access to essential health care benefits. The Foundation’s long-term goal is to impose enforceable regulations on drug pricing to balance market equity. It also seeks a framework for pharmaceutical firms to disclose charged costs and subsidies to patients. AbbVie, representing the defendant, counteracts the Foundation’s claims by denying exceed prices and citing pandemic-relatedwriter compromising formal connections. However, the company adds minor discrepancies in calculations, including over(pos-affiliated costs due to research and development and parental discounts. The Foundation’s argument about price gouging is challenged by disputes with “sorry prices” that burden healthcare systems. While the Foundation Falconize throughout challenges, do these prices hold up? It depends on competitors or profitability measures rather than market structure. In the judicial proceedings announced on May 9, the Foundation leans against AbbVie, seeking a panel of judges to evaluate the case. If the outcome overturns the Foundation’s stance, it may getKey establish social and European standards for pricing. Summing up: The Dutch Pharmaceutical Accountability Foundation is taking legal action against AbbVie for allegedly profiting unfairly. The Foundation argues that excessive profits and “human rights” embeddings are in question, drawing parallels to consumer-controlled economics. The case highlights the challenges in balancing market dynamics, pricing fairness, and consumer protection. AbbotVie’s decline under these criteria, combined with market structures and competition, presents significant hurdles. The case is set to impact Dutch healthcare systems and European regulation in pricing_ai healthcare related to a possible 6-12-week outcome. //