Nvidia’s Ascent Towards a $4 Trillion Valuation Fueled by AI Dominance

Nvidia, the undisputed leader in the generative artificial intelligence revolution, experienced a remarkable surge in market value on Monday, January 15, 2025, adding approximately $140 billion and briefly surpassing Apple as the world’s most valuable company. This meteoric rise, driven by anticipation surrounding CEO Jensen Huang’s keynote address at the CES 2025 technology conference, underscores Nvidia’s pivotal role in the burgeoning AI landscape. The company’s shares climbed 3.4% to a record-breaking $149.43, propelling its market capitalization to a staggering $3.73 trillion, a mere $40 billion shy of achieving a historic $4 trillion valuation. This surge came amidst a broader rally in the technology sector, with the Nasdaq hitting a 2025 high, and a global upswing in semiconductor stocks, including ASML, TSMC, and Arm Holdings.

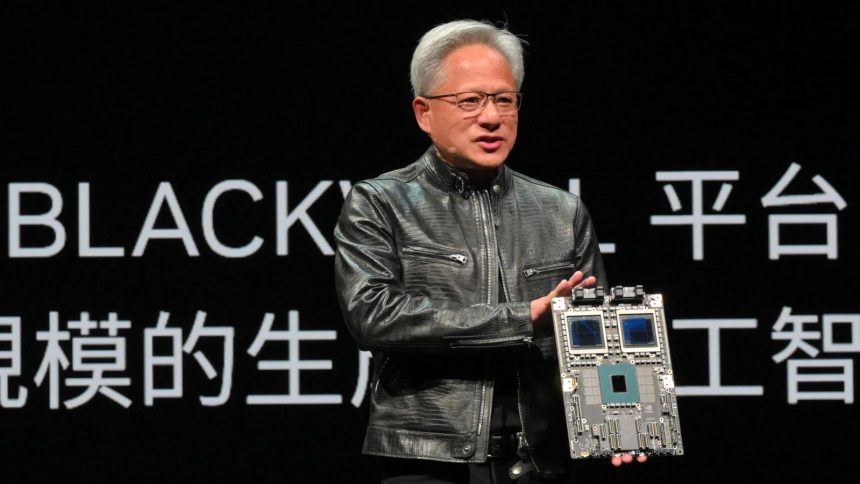

Several factors contributed to this market enthusiasm. Firstly, record fourth-quarter revenue data from Taiwanese manufacturer Foxconn provided a bullish signal for upcoming Q4 results from Nvidia and other AI-related companies. Secondly, a report suggesting that incoming President Trump’s tariffs would initially spare the semiconductor industry, alleviating concerns about potential disruptions to the global supply chain crucial for chip production, further boosted investor confidence. This positive outlook, combined with the eager anticipation of Huang’s keynote address, created a perfect storm for Nvidia’s stock price. Analysts anticipated "reassuring updates" on the company’s Blackwell and Rubin graphics processing unit (GPU) systems, predicting a "positive catalyst" for the stock. The expectation was that Huang would articulate Nvidia’s competitive advantage in providing the full technological stack necessary for powering AI, further solidifying its position as a market leader.

Nvidia’s dominance in the AI arena stems from its design and production of the majority of custom semiconductor chips that power generative AI systems. Its impressive client roster includes tech giants like Amazon, Meta, OpenAI, and Elon Musk’s xAI, highlighting the widespread adoption of its technology. Founded in 1993, Nvidia initially focused on video game graphics but has since transformed into the face of the 2020s AI boom. The company’s share price has skyrocketed by an astounding 786% since November 30, 2022, the launch date of OpenAI’s ChatGPT, turning a $1,000 investment into nearly $9,000 in just over a year. This explosive growth reflects the market’s recognition of Nvidia’s crucial role in the rapidly expanding AI sector.

The surge in Nvidia’s stock price also significantly impacted CEO Jensen Huang’s personal wealth. His net worth increased by approximately $5 billion on Monday, making him the ninth-richest person globally with a fortune estimated at $131 billion. This wealth has grown more than twentyfold over the past five years, largely due to his 3.5% stake in Nvidia, the largest individual holding in the company. This remarkable wealth accumulation underscores the extraordinary value creation driven by the AI revolution and Nvidia’s position at its forefront. Huang’s leadership and the company’s innovative technology have positioned Nvidia as a key player in shaping the future of artificial intelligence.

Nvidia’s journey to becoming a potential $4 trillion company represents a remarkable success story in the tech world. The company’s transformation from a gaming graphics specialist to an AI powerhouse highlights its adaptability and strategic vision. The anticipated updates on Blackwell and Rubin GPU systems during Huang’s CES keynote address are expected to further reinforce Nvidia’s technological leadership and market dominance. These advanced GPU systems are designed to meet the increasing demands of AI workloads, offering enhanced performance and efficiency for complex AI tasks.

The broader market rally in technology stocks, coupled with the positive sentiment surrounding the semiconductor industry, creates a favorable environment for Nvidia’s continued growth. The company’s focus on providing a comprehensive suite of AI-powering technologies, from hardware to software and platforms, further strengthens its competitive advantage. As the AI revolution continues to unfold, Nvidia is well-positioned to capitalize on the expanding market opportunities and potentially achieve the unprecedented milestone of a $4 trillion valuation. This achievement would solidify Nvidia’s position as a true titan of the technology industry, driving innovation and shaping the future of artificial intelligence across various sectors.