The emergence of Chinese generative AI startup DeepSeek sent shockwaves through the U.S. stock market on Monday, triggering a dramatic reassessment of the American tech landscape and inflicting substantial losses on some of the world’s wealthiest individuals. DeepSeek’s unveiling of a large-language model, developed at a purportedly lower cost than competitors like OpenAI’s ChatGPT, sparked concerns about the sustainability of lavish spending on AI technology, impacting investor confidence in companies heavily invested in this area. This market disruption underscored the intensifying global competition in the burgeoning field of artificial intelligence.

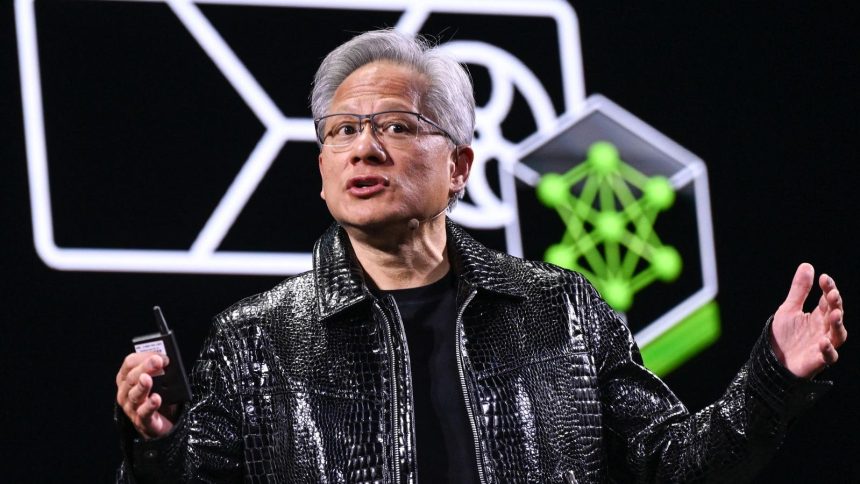

Nvidia, the American leader in AI hardware, bore the brunt of the market’s reaction. The company’s stock plummeted 17%, resulting in a staggering $600 billion wipeout from its market capitalization. This precipitous decline directly impacted Nvidia CEO Jensen Huang, the company’s largest individual shareholder, whose net worth plunged by $21.3 billion. Huang’s dramatic loss of wealth saw him tumble down the ranks of the world’s richest individuals, highlighting the vulnerability of even the most successful tech fortunes to rapid market shifts.

Oracle, another major player in the tech sector, also suffered significant losses. Chairman Larry Ellison saw his fortune diminish by $29.4 billion as Oracle stock tumbled 15%. This substantial decline pushed Ellison down the global wealth rankings, illustrating the interconnectedness of tech fortunes and the ripple effect of market disruptions. The losses incurred by both Huang and Ellison underscore the immense sums at stake in the rapidly evolving AI landscape and the potential for rapid wealth redistribution as the industry matures.

The market’s reaction extended beyond Nvidia and Oracle, impacting a broader range of tech giants. The ripple effect of DeepSeek’s entrance into the market cast a shadow over the valuations of major American tech companies, raising questions about the long-term viability of their AI-driven growth strategies. This widespread impact suggests a broader market recalibration in response to the intensifying competition in the AI arena and the potential for disruption from lower-cost alternatives.

While the tech sector largely experienced a downturn, Apple proved a notable exception. Its stock price rose more than 4%, likely attributed to its comparatively less intensive investment in AI compared to its peers. This divergence suggests that the market’s reaction was specifically targeted towards companies perceived as overexposed to potentially unsustainable AI spending. Apple’s performance, in contrast, highlighted the potential benefits of a more measured approach to AI investment in the face of emerging competition.

Amidst the widespread tech sell-off, Warren Buffett emerged as a significant winner. His Berkshire Hathaway conglomerate, with its substantial stake in Apple, benefited from the iPhone maker’s positive performance, adding $2.3 billion to Buffett’s already considerable fortune. This outcome further reinforces the importance of diversified investments and the potential for gains even in volatile market conditions. Apple’s CEO Tim Cook and the widow of Steve Jobs, Laurene Powell Jobs, also saw their wealth increase due to Apple’s resilient performance, further emphasizing the company’s unique position in the market during this period of uncertainty.