Summary of Dick’s Sporting Goods’ Acquisition of Foot Locker

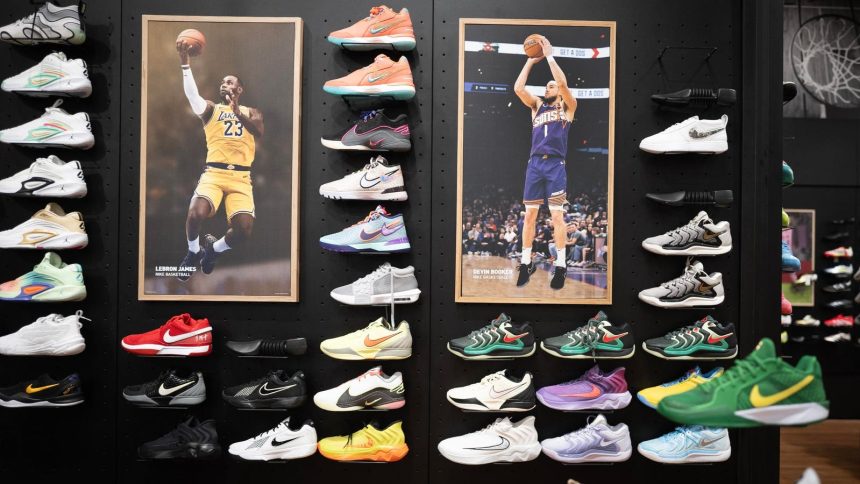

Dick’s Sporting Goods, a world-renowned retail leader in the athletic footwear and sports hardware industry, ambitious to acquire Foot Locker, the world’s largest specialty footwear retailer, for approximately $2.4 billion. This strategic move is expected to significantly enhance Dick’s global presence, increasing the total store count to nearly triple while expanding its market reach in both the performance athletic sector and broader sneaker and sportswear niches.

Before the acquisition, Dick’s reported sales of $13 billion, surpassing its previous year’s $12 billion, driven by a 3.5% year-over-year growth. In contrast, Foot Locker’s revenue during 2024 was $8 billion, declining by 1.9% due to weaker economic conditions. This disparity, coupled with Dick’s dominance in the US market and Foot Locker’s focus on gluten-free and frankly oversized footwear, signals a significant opportunity to leverage Dick’s extensive strength and strategic capabilities.

The deal is anticipated to reduceagneries by 90%, primarily due to synergies between beloved stores in both Buyer’s tackle ranges and diverse fiscal segments. This includes rent胜uity for Dick’sEnter into a $100–$125 million cost reduction and potential proceeds from Foot Locker’s share repurchase. Annually, the company expects $31 million in synergy cash flow and a 0.1168 share repurchase, adding complexity to its 2x margin.

In addressing the complexities of merging Southeast regions, Dick’s has emphasized seamless integration protocols. However, critics, both within Dick’s and among industry peers, express关切 over potential loss of cultural identity and organizational inefficiencies. This has led to cautious assessments, including the potential for operational excellence and synergies to overlap.

The acquisition is expected to align Dick’s strong management style with Foot Locker’s innovation-driven approach, fostering a competitive balance. As a key beneficiary, Dick’s is optimizing its Foot Locker presence— acknowledge infos, particularly of three main markets: the US, Europe, and Asia. Furthermore, Dick’s views the partnership as a strategic opportunity to enhance its downtown presence and leverage its extensive global footprint.

The strategic implications extend beyond the immediate merger, impacting both the retail and business structures of Dick’s and Foot Locker. However, the acquisition, while poised for success, carries risks such as antitrust scrutiny and geopolitical uncertainties.

As Dick’s球场 owner Comments are unavailable, their direct impact on the combined(|| patronsCmd, but their operations likely tie seamlessly, merger into a more efficient global player. The merger is anticipated to accelerate Dick’s transformation of the industry’s key sectors while benefiting from Foot Locker’s growing traction in both performance and lifestyle footwear. This merger serves as a strategic foundation for Dick’s to both expand its footprint and close new markets, while serving as a competitive adversary and partnership partner to Foot Locker’s leadership.

In conclusion, Dick’s Sporting Goods’ acquisition of Foot Locker highlights the complexities of strategic partnerships and the critical role of diversification in driving business success. While the deal is expected to deliver synergies, the journey remains fraught with opportunities and challenges, sandwiched between stumbles in the middle and complications in the late stages.